Getting started in real estate can feel like navigating a complex maze, but with interest rates stabilizing, rental demand remaining strong, and new technological tools enhancing accessibility, 2025 presents a promising landscape for first-time real estate investors. Success, however, hinges on a strategic, data-backed approach. This guide breaks down five key moves that can position you for long-term success, drawing insights from industry leaders like NAR, MBA, CoStar, ATTOM Data Solutions, and critically, the "TOP MARKETS 2025" data.

1. Start in Top Growth Markets Identified for 2025

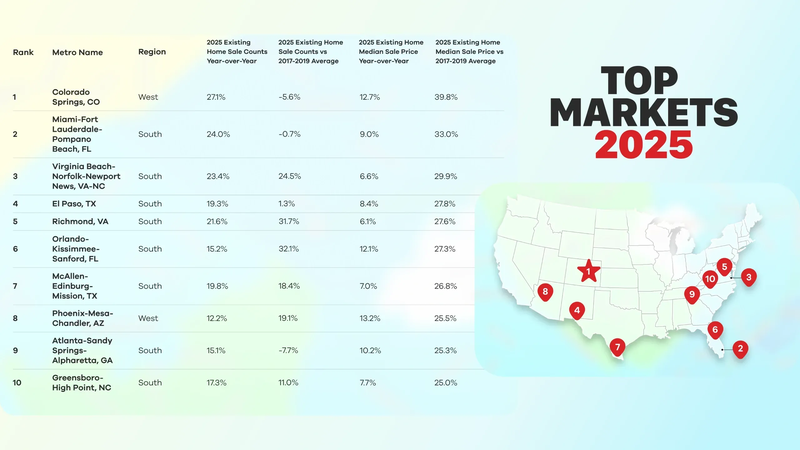

Choosing the right location is paramount. Focus on cities and regions demonstrating robust housing demand driven by factors like strong job creation, population influx, and infrastructure development. The "TOP MARKETS 2025" data highlights several standout areas to consider:

- Colorado Springs, CO (West): Ranks #1, showing an impressive 27.1% year-over-year increase in 2025 Existing Home Sale Counts and a substantial 39.8% surge in Median Sale Price compared to the 2017-2019 average. Its growth trajectory makes it a prime target.

- Miami-Fort Lauderdale-Pompano Beach, FL (South): At #2, this South Florida metro shows 24.0% year-over-year growth in home sales and a strong 33.0% increase in Median Sale Price since 2017-2019.

- Virginia Beach-Norfolk-Newport News, VA-NC (South): Ranking #3, this region is experiencing significant sales activity with a 23.4% year-over-year rise in home sale counts and a robust 29.9% increase in Median Sale Price against pre-pandemic levels.

- Orlando-Kissimmee-Sanford, FL (South): Holding the #6 spot, this Florida market shows a 15.2% year-over-year growth in existing home sales and a notable 27.3% increase in median sale price compared to the 2017-2019 average.

These markets, along with others like El Paso, Richmond, and McAllen-Edinburg-Mission, offer environments ripe for sustained appreciation and rental income.

Tip: Beyond the macro data, dig into local specifics. Look for new job announcements, major transit expansions, or significant university growth, as these are often precursors to sustained housing demand and value appreciation.

Fact: ATTOM reports that counties with major infrastructure projects saw rental yields 1-2 percentage points higher than surrounding areas in 2024, underlining the importance of looking beyond just existing metrics to future development.

2. Consider Small Multifamily Properties for Diversification

For first-time investors, duplexes, triplexes, and fourplexes (small multifamily properties) present an excellent entry point. They offer inherent diversification of income streams, reducing risk if one unit is vacant, and can often qualify for more favorable residential financing.

ATTOM data from 2024 indicates that small multifamily rental yields averaged a healthy 6-8% in affordable markets. While specific "TOP MARKETS 2025" like Colorado Springs or Miami might be more competitive for these, the underlying strategy remains solid.

Tip: Consider "owner-occupying" one unit. This strategy allows you to qualify for lower down payments and potentially better loan terms (e.g., FHA loans), significantly easing your initial capital outlay.

Example: While not explicitly in the "TOP MARKETS 2025" list, historical data from markets like Indianapolis show that small multifamily investors achieved average gross rental yields of 7.5% in 2024, among the highest in the Midwest, demonstrating the potential of this strategy in the right conditions.

3. Utilize House Hacking to Build Equity Faster

House hacking is a powerful strategy for new investors looking to reduce personal housing costs while building equity. It involves purchasing a primary residence and simultaneously generating rental income from part of it – whether through an Accessory Dwelling Unit (ADU), a basement apartment, or by renting out spare rooms. This income directly offsets your mortgage, accelerating your equity growth. Insight: A NAR survey from 2024 revealed that 15% of millennial homeowners successfully generated income from house hacking strategies, underscoring its growing popularity and effectiveness among younger investors.

Tip: Before committing, always thoroughly research local zoning laws and permitting requirements. Regulations vary widely by municipality, and understanding them upfront can save you from costly surprises.

4. Leverage New Real Estate Technology Tools

The barrier to entry for real estate investing has significantly lowered thanks to advancements in technology. New tech tools, from fractional ownership platforms that allow investment in smaller increments, to AI-driven market analysis software, are empowering first-time investors. These platforms can help you:

- Identify promising markets: Tools can quickly analyze vast datasets to pinpoint areas matching your investment criteria, potentially even within the "TOP MARKETS 2025" list or similar growth regions.

- Estimate returns: Sophisticated calculators can project potential cash flow, ROI, and appreciation based on various inputs.

- Streamline property management: Digital platforms can automate rent collection, maintenance requests, and tenant communication.

Fact: According to the MBA, nearly 20% of first-time investors in 2024 leveraged digital platforms to access properties outside their local area, demonstrating how technology is breaking down geographical barriers to investment.

Tip: While these platforms offer incredible convenience, always conduct due diligence. Thoroughly research the track record, fee structures, and user reviews of any investment platform before committing your capital.

5. Prioritize Long-Term Fundamentals and Market Resilience

In a dynamic market, it's easy to be swayed by short-term hype or fleeting trends. True long-term success in real estate investing, especially for first-timers, comes from focusing on strong fundamentals. This means identifying properties with robust cash flow potential situated in areas exhibiting economic resilience and existing housing shortages.

Consider the underlying economic health of a market. Does it have diverse industries? Is its population growing steadily? These factors contribute to sustained rental demand and property value appreciation, even if specific growth rates vary.

Tip: Always run multiple cash flow scenarios for any potential property. Stress-test your assumptions by factoring in higher vacancy rates, unexpected repairs, or increased interest rates to ensure your investment remains viable under various conditions.

Example: While the "TOP MARKETS 2025" table highlights current growth, consider that regions like the Sun Belt metros (many of which appear in the top 10, such as Miami, Orlando, El Paso, Richmond, McAllen, Atlanta, Greensboro) that investors targeted between 2020-2022 saw average equity gains of 15% by 2024. This was driven by steady rent growth and consistent demand, proving the power of long-term vision in fundamentally strong markets.

Key Takeaways

- Targeted Growth: Focus on top-performing markets identified by data, particularly those showing strong sales count growth and median price appreciation.

- Smart Entry Points: Small multifamily properties, combined with savvy financing strategies like house hacking, offer excellent ways for first-timers to enter the market.

- Tech-Enabled Advantage: Leverage new digital tools to research, analyze, and manage your investments more efficiently.

- Patience and Data: Long-term wealth in real estate is built through informed, cautious, and data-driven decisions that prioritize fundamental market health over speculative trends.

The Bottom Line: Smart Starts Lead to Strong Futures

Real estate investing in 2025 is full of opportunity, but for first-time investors, success isn't just about jumping in. It's about staying informed, exercising caution, and steadfastly focusing on proven fundamentals and data-backed market insights. By doing so, you can lay a solid foundation for lasting financial growth.