San Francisco's downtown core, once a beacon of innovation and sky-high property values, is facing an undeniable crisis of demand. Empty office spaces, declining foot traffic, and shuttered storefronts paint a stark picture. For real estate investors, the critical question isn't just about the fate of the city center, but the ripple effect: what does this persistent urban demand slump signal for the surrounding suburban markets? Is it a harbinger of broader weakness, or does it present a unique opportunity for suburban growth?

The Unraveling of Downtown San Francisco

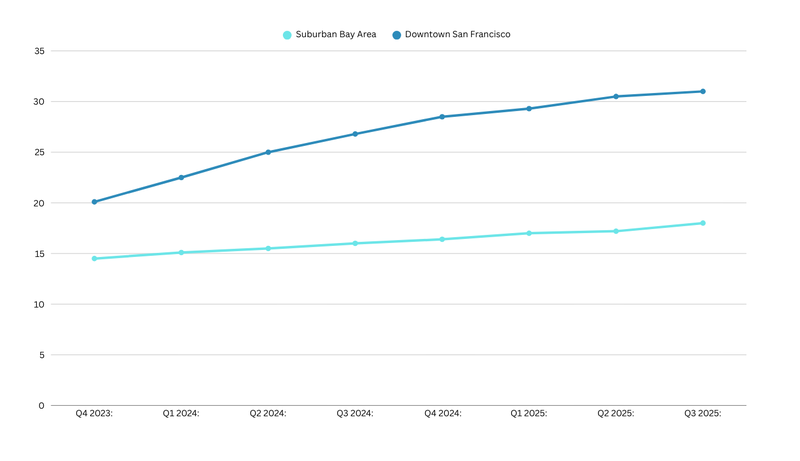

Data from sources like CoStar and Moody's Analytics confirm a severe downturn in San Francisco's commercial heart. Office vacancy rates in the Financial District and South of Market (SoMa) have surged past 30%, a historic high that dwarfs pre-pandemic levels. Asking rents are down by 15-20% from their peak, and transaction volumes for commercial properties have plummeted. This isn't just a temporary adjustment; it’s a structural shift.

The primary driver is remote and hybrid work models, which have fundamentally altered corporate real estate needs. Tech giants, once the engine of downtown’s prosperity, are either downsizing their physical footprints or decentralizing their operations. This commercial vacancy crisis inevitably impacts retail and hospitality, leading to a negative feedback loop that erodes the vibrant urban ecosystem.

Expert Quote: "San Francisco's downtown market is undergoing a painful but necessary recalibration," states Dr. Evelyn Reed, a leading urban economist at a Bay Area think tank. "The question now isn't if the demand is shifting, but where it's settling, and for how long."

Suburban Resilience: A Diverging Path?

Historically, a downtown slump would send shivers through the entire metropolitan area. However, the current narrative for San Francisco's suburbs appears to be more nuanced, showcasing a surprising degree of resilience in certain segments.

Residential: Communities like Marin County, Contra Costa County, and parts of the Peninsula initially saw a surge in residential demand during the pandemic, driven by urban flight. While this frenzy has moderated with rising interest rates, these areas are generally holding their value better than the urban core. Redfin data indicates that median home prices in these suburban counties have seen modest annual appreciation of 3-5%, compared to the city's flat or slightly negative performance. Investors in single-family rentals or smaller multi-family units might still find value here, driven by families seeking more space and better schools.

Suburban Office: The story is mixed. While some suburban office parks are benefiting from companies decentralizing and seeking lower-cost, amenity-rich locations closer to their employees' homes, others are struggling with older inventory. CoreLogic data suggests that Class A suburban office vacancies are lower than downtown's, typically ranging from 15-20%, but still represent a tenant's market. Investors must be highly selective, prioritizing modern, flexible spaces with strong transit links.

Suburban Retail & Industrial: These sectors are showing more positive signs. Retail in well-established suburban centers is benefiting from increased local foot traffic as residents spend more time closer to home. Industrial and logistics facilities in the wider Bay Area continue to perform strongly, fueled by e-commerce and last-mile delivery needs, even if not at the same frenetic pace as a year ago.

Foresight: What Lies Ahead for the Bay Area Investor

The downtown demand dip is not a simple transfer of activity to the suburbs; it's a complex redistribution. Investors need to embrace this new reality with granular analysis.

- Residential Strength in Select Suburbs: Look for areas with excellent school districts, established amenities, and good connectivity. These will continue to attract families and professionals seeking a balanced lifestyle.

- Office Market Segmentation: Avoid older, less attractive suburban office stock. Focus on modern, highly amenitized properties that cater to smaller, more flexible tenants or companies specifically moving out of downtown.

- Industrial's Continued Edge: The underlying demand for logistics and distribution within the Bay Area remains robust, making suburban industrial a relatively safer bet.

- The "Hub-and-Spoke" Model: Companies are likely adopting a model where a smaller, central downtown office serves as a collaboration hub, complemented by satellite offices in suburban locations. This creates opportunities in key suburban nodes.

Key Takeaways

- Downtown Crisis: San Francisco's downtown commercial real estate faces unprecedented vacancy rates (over 30%) and declining rents due to hybrid work.

- Suburban Resilience: Suburban residential markets show modest appreciation (3-5%), while some suburban office segments are stable or improving.

- Diverging Trends: The Bay Area market is not monolithic. Downtown's woes do not automatically equate to a suburban downturn; rather, they signal a redistribution of demand.

- Investor Focus: Investors should target well-located suburban residential, modern suburban office, and robust industrial properties, understanding the nuances of the new "hub-and-spoke" corporate model.